1. Traditional

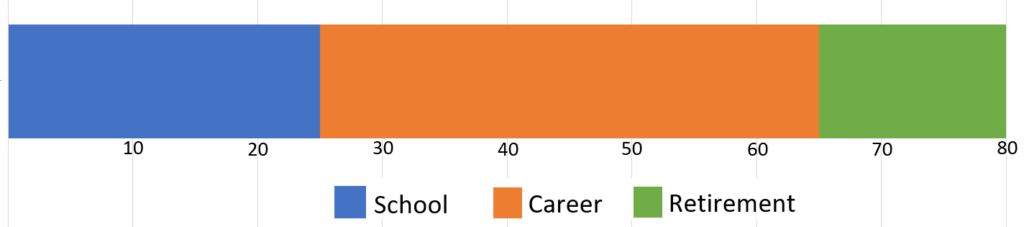

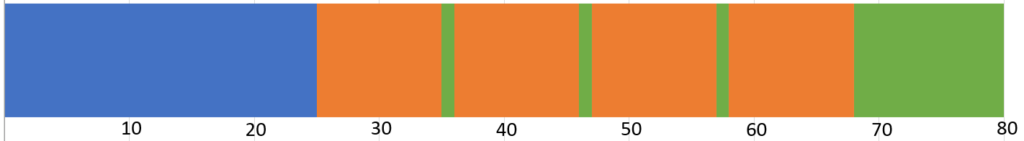

The traditional career path goes something like this:

My problem with the traditional trajectory is that is forces you to postpone many of your personal goals until late in life. By the time you reach retirement, you may be too old to do the dreams you had when you were young. Delayed gratification has its place, but it can come at a cost. The moment, or the opportunity, may have passed.

Don’t get me wrong, many people in their 60s, 70s, and 80s do truly amazing things. Traditional retirements can be enormously rewarding and fulfilling.

But there is a risk in deferring your goals. I may be perfectly capable of hiking the Appalachian Trail, for example, when I’m 70. But I also might not, and I don’t want take that risk.

Let’s explore some alternatives.

2. Early Retirement through FIRE

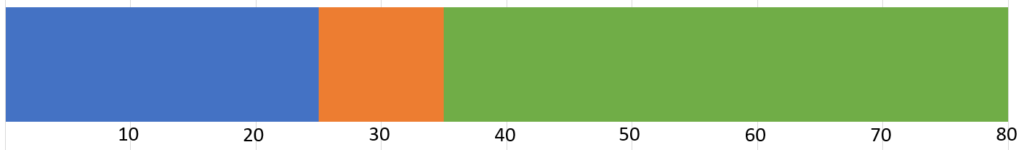

FIRE (Financial Independence, Retire Early) is a movement that revolves around the goal of reaching financial independence. FIRE folks generally focus on maximizing income while saving and investing aggressively. Using these principles, many are able to retire at an early age, often even in their 30s.

The term “early retirement” is a little misleading. Many FIRE early retirees do continue to earn an income post-retirement. But because they’ve reached a net worth where work is optional, they have complete autonomy over where they spend their time and energy. They are free to pursue passion projects, volunteer, travel, raise kids, etc.

Recommended Reading

- What is the FIRE Movement? Article by Dave Ramsey

- Financial Independence 101 Free course from ChooseFI

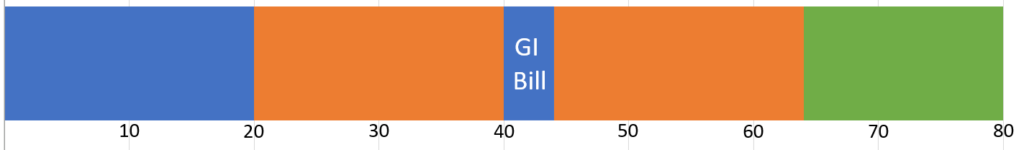

3. Military Career

A service member can generally retire from the military after 20 years of active service, though the longer you stay in, the higher the retirement pension. In addition to being one of the few careers that still offers a pension, the military also provides routine promotions and pay raises, housing allowance, free healthcare, and tax-free income – all helpful tools to set up a high savings rate.

Many veterans feel that their retirement pension alone wouldn’t be enough to live on and continue to work after retiring from the military. Since most join in their late teens or early twenties, they often retire young enough to have a whole second career. Someone who entered the service at 18 for example could retire with a pension as early as 38.

Recommended Reading

- Military Money Manual Book by Spencer Reese

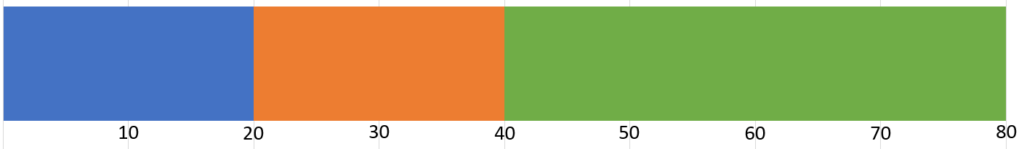

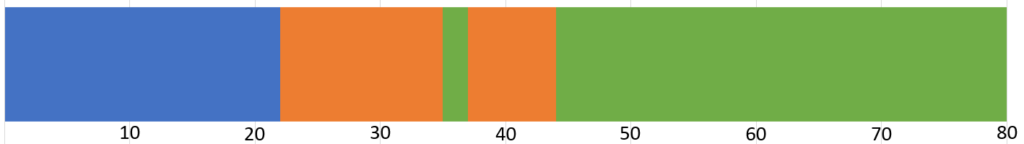

4. Military/FIRE Combo

By applying the principles of FIRE, some service members can get away without a second career. Through careful planning and smart money choices, they can reach financial independence in conjunction with their military retirement. The military pension is supplemented with proceeds from investments and/or passive income sources, providing enough to live on.

Again I want to point out that the green bar doesn’t necessarily mean that you will never work a day again. Work is not the enemy, but reaching financial independence means that you have the autonomy to chose where and when to work.

Recommended Listening

- Military FIRE Episode 24 by Military Money Manual Podcast

5. Mini-Retirement(s)

A mini-retirement offers the opportunity to insert some of the benefits of retirement earlier in life. It also has the added benefit of breaking up your career. Instead of one long monotonous stretch, you can enjoy the opportunity to take a break, clear your mind, and later return to the workforce refreshed.

I think one of the traps of the FIRE movement is single-mindedly focusing on retirement. “Once I’m finally retired, only THEN will I be able to do cool stuff.” Well, what about now? Obsessing about the future means you miss the opportunity to live in the moment. A mini-retirement can enable you to do so.

Recommended Reading

- Mini-Retirement Workbook Free downloadable workbook by Jillian Johnsrud

6. My Plan

There are endless variations on the above methods. My personal career trajectory is the Military/FIRE combo with a mini-retirement inserted.

With my 2-year sabbatical, my retirement age gets pushed from 42 to 44 – still pretty young compared to a traditional retirement age of 65+.

Which one of these resonates with you? Let me know in the comments.

Alas, my life defies all models. I volunteered for national and international orgs and worked for underpaying nonprofits through my twenties, so I worked hard but made no sizable retirement contributions. I took an 18 month retirement at age 30 when I tired of that model, but didn’t know how to pivot. I went back to my field and built a career track from the skills I’d acquired in my decade of “play-work.” Over the next few few years I quadrupled my annual income but kept my cost of living about the same, allowing me to catch up somewhat on retirement investments. Now in my late 30’s I am “retired” again from my career and building a business based on what I will still want to be doing when I am 75 (as best as I can predict). I am inspired by women like Jean Houston (85), Rita Moreno (91), and Dolly Parton (77) who are still at the top of their career, not because they can’t retire financially, but because it’s who they are to keep contributing to the world at the highest level. Instead of working an exhausting career so I can retire asap, I’m building an energizing career so I never want to!

That’s great stuff. There are so many different kinds of non-traditional paths. Ultimately, whether you’re trying to retire early or work until your 90s, I think the main goal is really the same – to find (or create) meaning and actively pursue personal fulfillment. It requires taking ownership and initiative, versus falling into the default path, and/or getting stuck in a rut.

ps. Never heard of Jean Houston before. She seems like she’s had a fascinating life.