Did I win the lottery? Did I marry a billionaire? How can I afford to take a two year unpaid sabbatical?

My Advantages

First off, I need to acknowledge my privilege. I’m an able-bodied white person in the richest country in the world. I grew up happy and comfortable and never wondered where my next meal would come from. I had an excellent high school education and my parents saved diligently to send me to college. Though I did have college student loans, I got most of them paid off though the Army student loan repayment program. My wife also works and we don’t have any kids.

I know that where I am is due in no small part to those advantages. Though my actions have certainly played a role in any success I’ve had in life, my underlying privilege has also contributed. Both are factors. Maybe it’s 50/50 (actions/privilege), maybe it’s 80/20. It’s hard to say exactly. Similar to the age-old nature vs. nurture debate, the answer is undoubtedly both.

The Military as a Tool for Financial Security

My mini-retirement is primarily funded by savings accumulated over 13 years in the Army. The day I left for basic training as a recent college graduate in 2009, I had $30 in my bank account. Since then I’ve lived frugally, saving and investing a large portion of my income. With tax-free allowances for housing and food, complete health insurance coverage, and many other benefits, the military has set me up for a high savings rate. We have a mortgage and my wife still has some student loans, but other than that we are debt-free.

Though I do have a college degree, my Army job is an enlisted position. I like my job as a musician, so I’ve chosen to stay on the enlisted side of the house instead of making more money as an officer. An enlisted career is available to people of many different backgrounds, no college required. Though I have an advantaged background, for many years the military has helped people pull themselves up out of disadvantaged backgrounds.

How I Approach Savings

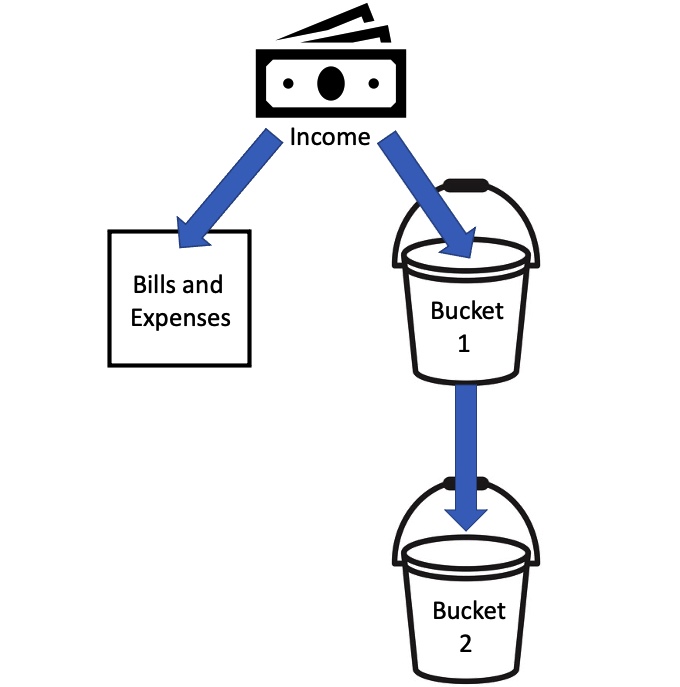

During my regular working life, this is how things flow. By keeping bills and expenses low, more money can go to my savings and investments (the “buckets”). This chart is overly simplified but it can help illustrate the concept.

Bucket 1

Bucket 1 is my long term retirement accounts. This money is placed in tax-advantaged retirement accounts, namely my Thrift Savings Plan (like a 401(k) for military), and an IRA. This is money I’ll access after the age 59 1/2, and won’t be touched until then.

Both TSPs and IRAs have annual maximum contribution limits, currently $20,500 and $6,000 respectively. If I fully max out the TSP and IRA for the year, then any remaining money gets put in Bucket 2.

Bucket 2

Bucket 2 is medium term money. Placed primarily in taxable brokerage accounts, its primary purpose is to be used to cover the period of time in between my Army retirement in my 40s and the age 59.5.

That period of time is a flexible one. Between my Army pension, Bucket 2, and my wife’s income (she will most likely continue to work during that period of time), we’ll have more than enough to pay the bills. It’s not that I’ll never work a day again after leaving the Army; I may in fact choose to continue working. But the point is, I’ll have the financial freedom to choose to work.

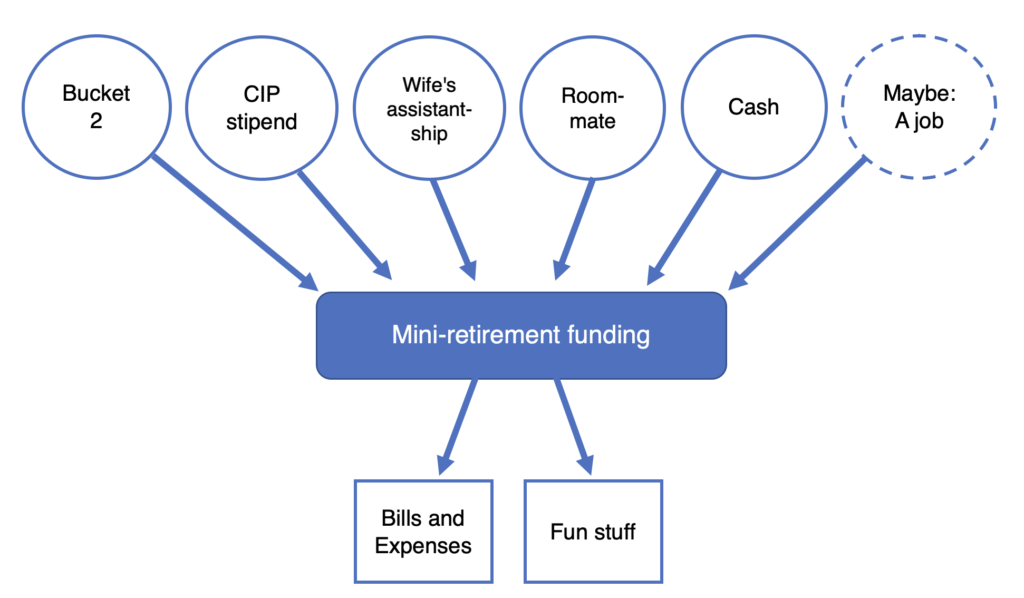

Borrowing from Bucket 2

I’m borrowing from my Bucket 2 to fund my mini-retirement. On my original timeline, Bucket 2 would be used from age 42 to age 59.5, a period of 17.5 years. I’m still basically using that money for its intended purpose, just drawing it earlier than originally planned.

Because I’m pausing my time in service, I will now retire from the Army at age 44. Bucket 2 will now be used from age 35-37 and 44-59.5, still a total of 17.5 years.

Other Income

In addition to money pulled from Bucket 2, funds for the mini-retirement come from a few other sources.

- CIP stipend – I receive two days of base pay a month during the Career Intermission Program (CIP), about $300.

- Wife’s assistantship – my wife is currently working on her PhD and receives a stipend from the university.

- Roommate – we are renting out the extra room in our house.

- Cash – As soon as I applied for CIP, I paused retirement contributions to instead save up some cash. There was about 5 months between when I first applied and when I was notified that I had been approved, but I wanted to start saving cash just in case I got approved.

- Maybe a job – during the “off season,” when not hiking the AT or PCT, I may choose to work some odd jobs to get some extra cash.

Problems

This plan definitely isn’t perfect. There are flaws. Some of them are listed below. They fall into 2 main categories, bad timing and opportunity cost.

Bad timing…

1. Stock market. The stock market has taken a hit, making 2022 the market’s worst year since 2008.

2. Portfolio balance. Because I wasn’t originally planning to use Bucket 2 until 2029, it was more stock-heavy than ideal for short term use. Short term money is best in less volatile mediums like cash or bonds. 2022 happened to be a good example of stock market volatility and I couldn’t have timed it worse.

Had I known more than 7 months in advance that I would be taking a mini-retirement, I would have slowly moved more stocks into bonds or cash. Alas.

Fortunately I was able to save up some cash by pausing contributions to my retirement accounts. I’m glad I did because I’ve been able to accumulate a cash buffer to minimize the impact to stock investments while the market is down.

3. Inflation. Oh and inflation is soaring in case you hadn’t heard. That cash I saved is losing value as we speak.

4. Wife going back to school. A few months ago my wife began her own amazing opportunity – going back to school full time to get her PhD. We have basically gone from a 2 income household to a no income household in the span of a few months. In a perfect world we could have staggered her school and my mini-retirement to soften the blow of income loss.

Opportunity Cost…

Opportunity cost is the loss of potential gain from other alternatives when one alternative is chosen. Choosing a mini-retirement means I lose the potential gains I could have received if I had kept the traditional career path.

1. Investment opportunity. Now would be a GREAT time to invest in the stock market and I’m missing out. With the market down, you get more share per dollar than when the market is doing well. Stocks are basically “on sale.” Assuming you have a long time horizon to let the market recover and grow, buying when the market is down is a good move.

2. Loss of potential returns. Because I’m withdrawing some money from Bucket 2 earlier than planned, I lose 7+ years of returns that the money could have accumulated.

3. Pension. I’ll receive a pension from the day I retire from the Army until I die. Because I’ll now be two years older when I retire from the Army, technically I’m loosing two years of pension (assuming my age of death remains the same).

Is This Wise?

Given this litany of problems, how could taking a mini-retirement possibly be a wise choice?

Well, how do you define wise?

If wise means making the most mathematically optimal decision, then no, this is not wise.

But there is more to life than math, no?

I’ve crunched the numbers and yeah I can swing this mini-retirement. The math is good enough. Maybe I’ll have to work a little longer in my 40s or 50s to make up the difference in my retirement accounts, but that’s totally ok.

Gains

I’m trading the losses above for gains in other areas. These gains aren’t quantifiable the way money is, but are extremely valuable nonetheless.

- An investment in life experiences.

- Two years of memories made in the prime of my life.

- The opportunity to:

- Pursue a lifelong dream.

- Cultivate an identity outside of my career.

- Become more well-rounded.

- Explore interests and try new things.

- Return to work refreshed.

Worth it? Absolutely.

My end goal in life is not a big number in my bank account; it’s a fulfilling life. Although money does play role in that, it’s not the goal itself. I’m able to do this mini-retirement through the compounding effect of frugal lifestyle and a high savings rate. Money is a wonderful tool. But tools are only valuable when they are used. It’s time for me to put my money tool to use!